8pC is a business advisory for shareholders who are asking the question - are we; stepping up, stepping back or stepping off

8pC is a business advisory for shareholders who are asking the question - are we; stepping up, stepping back or stepping off

A businesses relationship with its bank is important. It is critical that as a business owner you understand how your bank assesses your business from a risk perspective. The banks assessment of your businesses risk profile or risk rating determines key factors that will impact you:

Your customer margin or more simply, the total interest rate you pay on the loans you have.

Your level of loan principal reductions.

The banks appetite to fund further business growth.

Access to additional working capital when you need it.

Where or who managers your account.

Banks in NZ have different risk rating models, however in general, the questions asked, the analysis completed, and the risk rated determined will be similar.

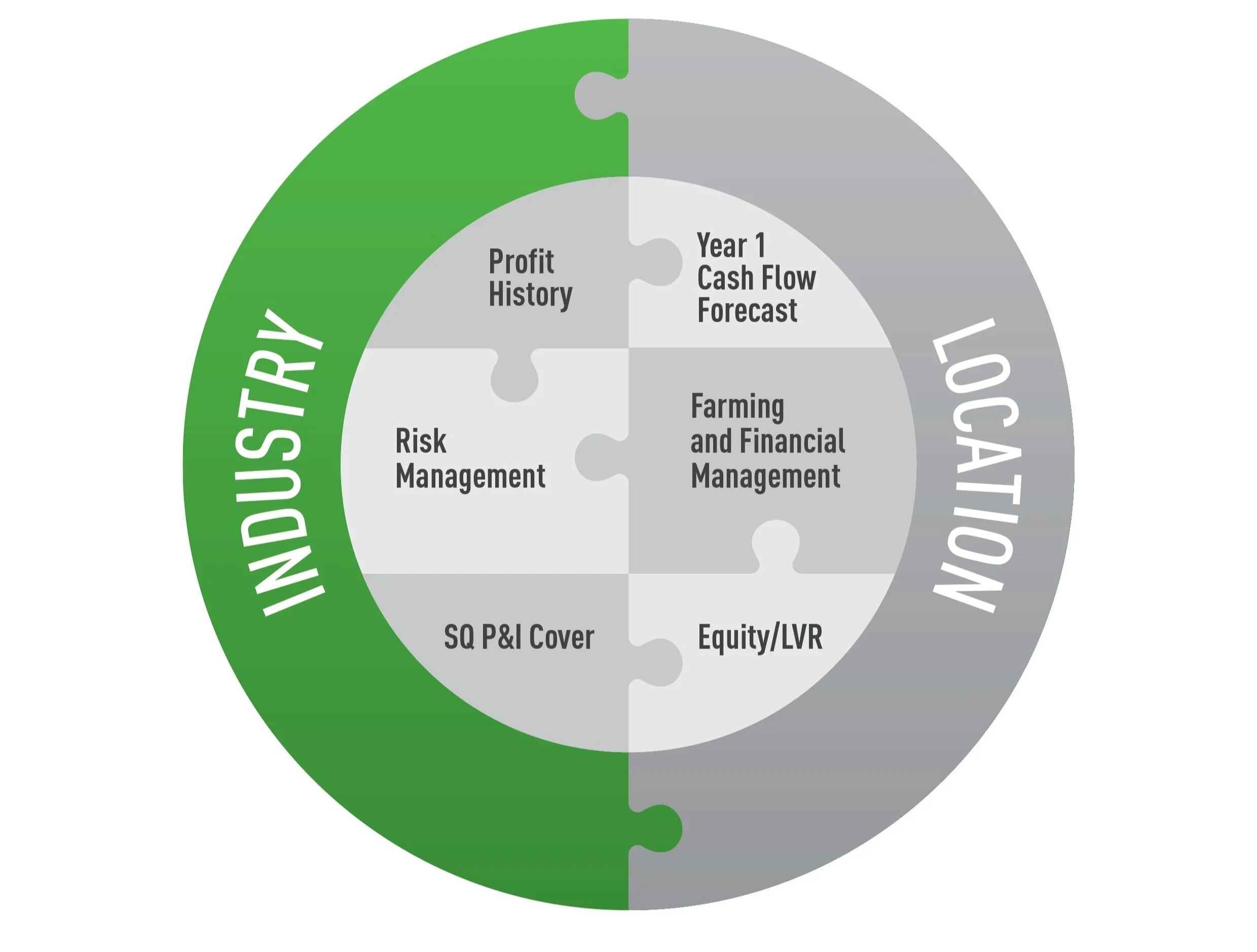

8pC represents the components of risk rating as a jigsaw. Pieces fit together to form a picture, in this case, a picture of your businesses risk rating. This program aims to empower you and your business through knowledge by providing the full picture of how your bank assesses your business.

Through this knowledge 8pC believes you will be empowered to focus on key areas of business management and lead the discussions you have with your bank. Is your business missing a piece of the puzzle? What pieces of the puzzle can you control, and which are outside of your influence or ability to change?

An analysis of your last 3 years financial history taken from your Financial Statements as prepared and provided by your Accountant. For risk rating purposes, the analysis will focus on the trading profit (or loss) achieved by your business in each year.

This is the current financial year (maybe the immediate next year if calculated in the second half of a financial year) cashflow budget forecast.

This forecast uses actual anticipated production levels, product prices, farm working expenses, interest rates, loan principal repayments and CAPEX.

Your bank will be interested in the anticipated cashflow profitability and your interest cover (IC) ratio. IC is calculated by taking your net profit then adding back loan interest payments, loan principal repayments and CAPEX, then dividing that number by your loan interest payment number.

What IC ratio is your business?

An important indicator of your risk rating is your businesses ability to meet both interest and principal repayments on a status quo (SQ) basis.

The term “SQ budget” refers to a hypothetical financial year in which the following occur:

Production performance reflects an average level for your farming operation considering the district averages and your own historical production performance.

Product prices are at standard bank SQ levels. These will be provided by the bank and are reflective of the banks long term average view for each income item.

Stock numbers / classes remain constant at opening and closing.

Only reoccurring and sustainable other farm and personal income is included.

Farm working expenses are included at maintenance levels.

Your banks loan interest rate is set at a standard bank SQ rate, like product prices above, reflective of the banks long term view.

Principal repayments are included based on your term debt being repaid over a 20-25 year period.

CAPEX is allocated at a level to maintain plant & equipment. For this purpose, the level of CAPEX is often set at 10% of the book value of the plant & equipment as indicated in your financial accounts.

To calculate the SQ P&I cover, the SQ profit plus the P&I payments from the SQ budget is divided by the total of the P&I payments in the SQ budget i.e. (C+B+A) / A

Does your business have a SQ P&I Cover >1?

Your business equity ($) is the difference between the market value of your business assets and the total of loans or liabilities your business owes to others. Equity in $ terms or as a % of the value of your business assets is a good indication of the financial robustness of your business and your businesses ability to withstand a period of financial downturn (unprofitable trading).

Your LVR is the ratio of your loans to a secured creditor (i.e. your bank) to the market value of the secured assets. In New Zealand, banks generally look for an LVR of less than 60% for rural lending, including working capital facilities.

What is your Equity % and LVR %?

This piece of the puzzle could be missing for many businesses and need a bit of focus to get back within acceptable parameters.

Farm Management – how does your production performance rate relative to the district/industry averages? Are you proactively managing your cashflow, and animal welfare and environmental management focus areas for your business?

Financial Management – do you complete budgets? Are you monitoring your budgets regularly? Are you comparing actuals to budget and adjusting your farm operation accordingly?

Risk comes in many forms and options are available to manage that risk. Your bank may prefer to see your business utilising risk management options available to it. Does your farm business have policy or procedures to manage risk? Types of risk management options include (but not limited to):

Fixed interest rate options

Milk price futures/options

Feed contracts

Irrigation

Insurance

Governance and succession

Governance is included under Risk Management in this model. Established and effective governance of your business will include policy and process setting for management of key risks your business faces. Governance will incorporate succession.

What risk management tools does your business utilise?

Do you have a governance framework in place for your business? Do you have a clear succession plan for your business?

Many businesses would benefit from improved governance and succession!

Your bank may allocate a risk weighting to your farming industry type (dairy, sheep, beef, poultry, pork, cropping, kiwifruit, pip fruit, etc). This weighting or score will reflect your banks medium to long term view of the risks associated with your industry. Where you farm across several industries, the one that makes up the biggest portion of farm income will most likely be applied.

Your bank may allocate different risk weightings to your farm location based on your industry type. The risk score will reflect if your industry type is proven in your location and your location is favourable in terms of climate and topography/soils to the industry i.e. kiwifruit in Bay of Plenty, apples in the Hawkes Bay, grapes in Marlborough, dairy in the Waikato, cropping in Canterbury and beef in the Manawatu are examples of locations and industry types with proven track records of working together to produce favourable results.